Introduction

In recent years, the global automotive industry has undergone a significant transformation, driven primarily by the surge in demand for electric vehicles (EVs). This shift has been fueled by advancements in battery technology, particularly in the realm of lithium-ion batteries. Among these, lithium iron phosphate (LFP) batteries have emerged as a frontrunner, claiming a significant market share. In June 2024, the China Automotive Battery Innovation Alliance reported that LFP batteries accounted for 74% of all new energy vehicle battery installations, marking a historic milestone in the evolution of battery technology. This article delves into the factors contributing to the resurgence of LFP batteries, their technological advancements, market trends, and future outlook.

Table 1: Key Market Share Statistics of LFP Batteries

| Month | LFP Battery Installations (GWh) | Total Battery Installations (GWh) | Market Share (%) |

|---|---|---|---|

| June 2023 | 25.4 | 37.6 | 67.6 |

| June 2024 | 31.7 | 42.8 | 74.0 |

The Rise of LFP Batteries: Factors and Drivers

Cost Advantage

One of the primary reasons for the resurgence of LFP batteries is their cost-effectiveness. The material costs associated with LFP batteries are significantly lower than those of nickel-cobalt-manganese (NCM) or nickel-cobalt-aluminum (NCA) batteries, which are commonly referred to as ternary batteries. The cost difference is primarily due to the abundant availability and lower price of iron compared to cobalt and nickel.

Table 2: Cost Comparison of Different Battery Types

| Battery Type | Material Cost per kWh (USD) |

|---|---|

| LFP | ~50−70 |

| NCM 811 | ~80−120 |

| NCA | ~100−150 |

As seen in Table 2, LFP batteries offer a substantial cost savings, making them an attractive option for automakers looking to reduce production costs and pass on these savings to consumers. This is particularly relevant in the context of the ongoing “price war” in the electric vehicles market, where cost competitiveness is paramount.

Technological Advancements

While cost savings have been a key driver, technological advancements have also played a crucial role in the resurgence of LFP batteries. Early versions of LFP batteries were known for their relatively low energy density, limiting their range and appeal to consumers. However, recent innovations have addressed these concerns, enhancing the performance of LFP batteries.

Table 3: Key Technological Advancements in LFP Batteries

| Advancement | Description | Impact |

|---|---|---|

| Nanostructuring | Enhances surface area, improves ion diffusion | Increased power density |

| Carbon Coating | Improves electrical conductivity | Better charge/discharge rates |

| Cell-to-Pack (CTP) Design | Removes the need for modules, simplifies packaging | Reduced weight, increased energy density |

| Blade Battery Design | Longer, thinner cells increase surface area | Enhanced heat dissipation, safety |

Market Trends and Key Players

Increasing Adoption Across Automakers

The rise of LFP batteries is evident in their widespread adoption by automakers globally. From traditional manufacturers to new entrants, LFP batteries are now a staple in many electric vehicles lineups.

Table 4: Selected Automakers and Their LFP Battery Usage

| Automaker | LFP Battery Model/Technology |

|---|---|

| Tesla | 4680 Battery Cells (LFP Variant) |

| BYD | Blade Battery Technology |

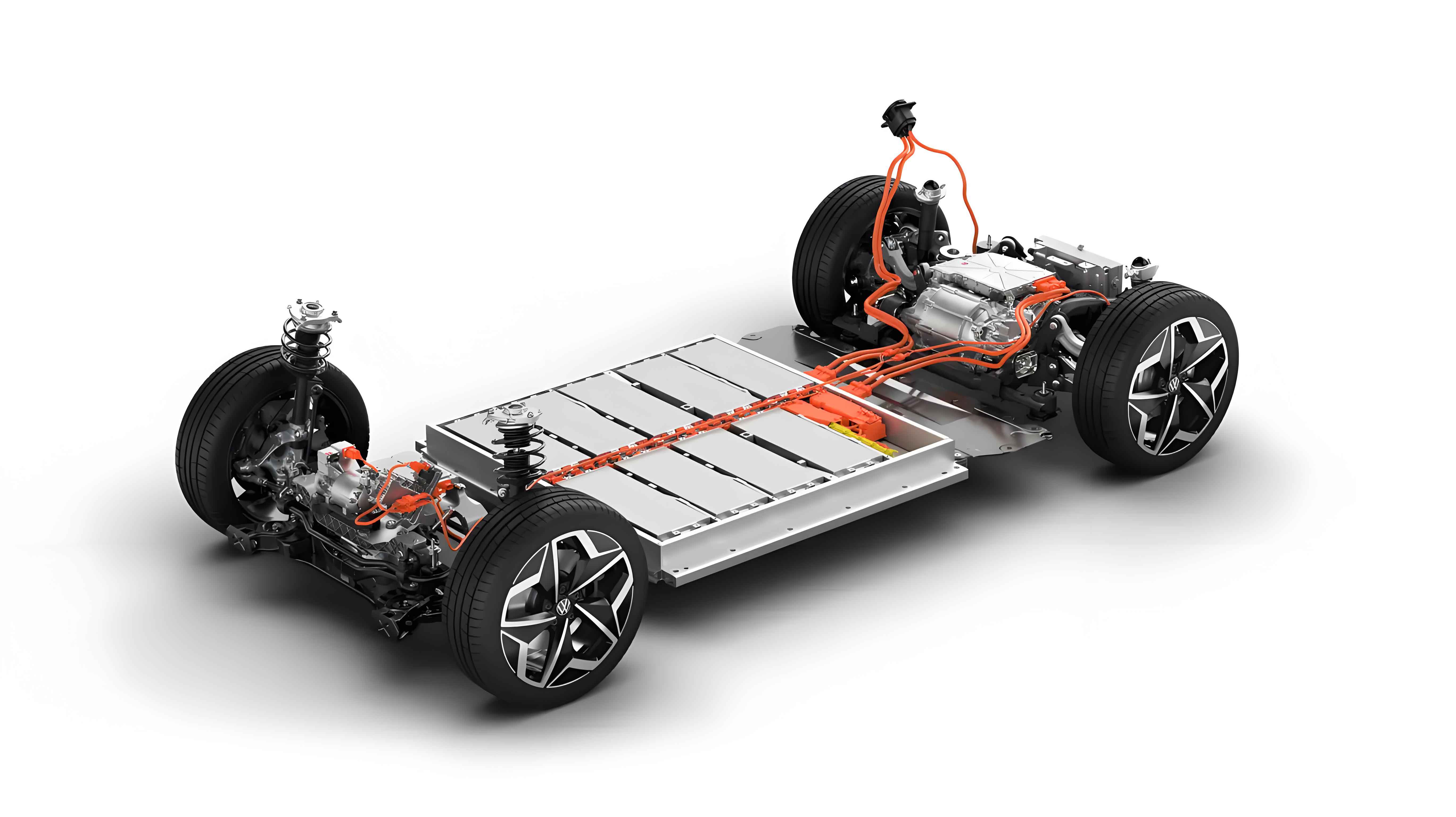

| Volkswagen | ID. Series with LFP Options |

| Nissan | LEAF with LFP Battery |

| Great Wall Motor | Ora Cat Series with LFP Battery |

Table 5: Global LFP Battery Production Capacity (2024)

| Manufacturer | Annual Production Capacity (GWh) |

|---|---|

| CATL | 150+ |

| BYD | 80+ |

| LG Chem | 40+ |

| EVE Energy | 30+ |

Competition and Collaborations

The LFP battery market is highly competitive, with leading battery manufacturers investing heavily in research and development to stay ahead of the curve. Collaborations with automakers have also become common, with battery suppliers working closely with vehicle manufacturers to tailor battery solutions that meet specific performance and cost requirements.

Future Outlook and Challenges

Market Forecast

The future outlook for LFP batteries is bright, with analysts predicting continued growth in market share. The cost advantage, combined with ongoing technological advancements, positions LFP batteries as a strong contender in the electric vehicles battery market.

Challenges and Opportunities

While the outlook is promising, LFP batteries face several challenges, including:

- Energy Density: While advancements have been made, LFP batteries still lag behind ternary batteries in terms of energy density.

- Recycling and Sustainability: As electric vehicles adoption grows, so does the need for effective battery recycling programs. Developing sustainable recycling solutions for LFP batteries will be crucial.

- Supply Chain Management: Ensuring a stable supply of raw materials, particularly iron and lithium, will be essential to maintain cost competitiveness and avoid supply chain disruptions.

Conclusion

The resurgence of lithium iron phosphate batteries is a testament to the power of technological innovation and cost competitiveness in shaping the future of the electric vehicles industry. With ongoing advancements and a favorable market environment, LFP batteries are poised to continue their ascendancy, playing a pivotal role in the global transition to sustainable mobility. As the industry navigates challenges related to energy density, sustainability, and supply chain management, the future of LFP batteries remains bright, offering a compelling value proposition for automakers and consumers alike.