As the global energy landscape shifts toward sustainability and reduced carbon emissions, the demand for advanced energy storage solutions has intensified. Solid-state batteries represent a transformative technology in this domain, offering superior energy density, enhanced safety, and longer cycle life compared to conventional liquid electrolyte-based lithium-ion batteries. The core component of solid-state batteries is the solid-state electrolyte, which eliminates flammable organic electrolytes, thereby mitigating risks of thermal runaway and combustion. This article provides a comprehensive analysis of patent trends in solid-state electrolytes, examining global and regional developments, key players, and technological advancements. By leveraging patent data, we aim to offer strategic insights to support innovation and high-quality development in the solid-state battery industry.

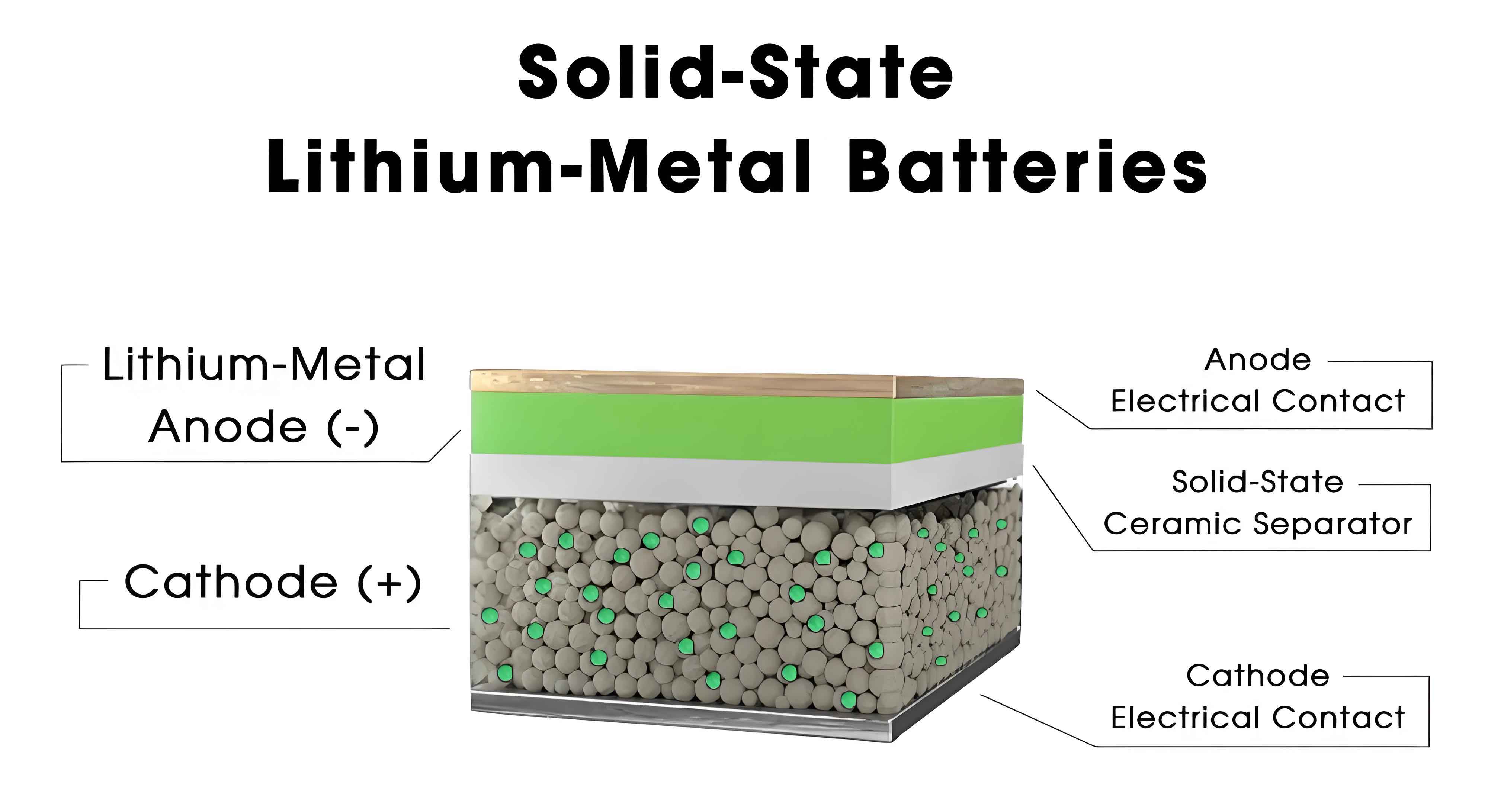

The fundamental principle of solid-state batteries involves replacing liquid electrolytes with solid-state electrolytes, which facilitate ion transport between electrodes without the need for volatile solvents. This design not only improves safety but also enables higher energy densities, potentially exceeding 300 Wh/kg, as solid-state systems can integrate high-capacity electrodes like lithium metal. The evolution of solid-state batteries has been driven by increasing investments in research and development, particularly in materials science focused on solid-state electrolytes. These electrolytes are categorized into three primary types: polymer-based, oxide-based, and sulfide-based systems, each with distinct advantages and limitations. For instance, polymer electrolytes offer flexibility and ease of processing but suffer from low ionic conductivity at room temperature, whereas sulfide electrolytes exhibit high ionic conductivity but are sensitive to moisture and air. Oxide electrolytes provide excellent stability but face challenges in mechanical brittleness and interfacial resistance.

To quantify the progress in solid-state battery technology, we analyzed patent data from 2005 to 2024, focusing on solid-state electrolyte innovations. The global patent landscape reveals a steady growth in filings, with a notable acceleration after 2015, coinciding with increased policy support and technological breakthroughs. China has emerged as a dominant force in patent applications, particularly in polymer and oxide electrolytes, while Japan maintains a stronghold in sulfide electrolytes. This analysis underscores the competitive dynamics among key regions and highlights opportunities for strategic patent布局 and collaboration. In the following sections, we delve into detailed patent trends, regional disparities, and critical patents held by leading applicants, concluding with recommendations for fostering innovation and global competitiveness in the solid-state battery sector.

Global Patent Trends in Solid-State Electrolytes

The analysis of patent applications for solid-state electrolytes reveals distinct phases of development. From 2005 to 2010, the global patent volume grew gradually, with an average annual increase of approximately 10%, indicating a period of technological accumulation. During this time, research was primarily exploratory, focusing on fundamental material properties and early-stage prototypes. The slow growth reflected the high technical barriers and uncertain commercialization prospects of solid-state batteries. However, from 2011 to 2015, patent filings accelerated, reaching 2,197 global applications in 2015, driven by incremental improvements in electrolyte conductivity and battery design. This phase marked a transition toward applied research, with companies and institutions investing more heavily in scalable solutions.

Post-2016, the solid-state battery industry entered a high-growth phase, with global patent applications surging to 6,542 by 2022. This explosion in innovation is attributed to several factors: the approaching theoretical limits of liquid lithium-ion batteries, advancements in solid-state electrolyte materials, and supportive policies worldwide. For example, China’s initiatives, such as the “New Energy Vehicle Industry Development Plan (2021-2035),” have incentivized rapid patent filings. The trend is further illustrated by the following table, which summarizes annual patent applications for solid-state electrolytes from 2005 to 2024:

| Year | Global Patent Applications | China Patent Applications |

|---|---|---|

| 2005 | 150 | 20 |

| 2006 | 180 | 25 |

| 2007 | 210 | 30 |

| 2008 | 250 | 35 |

| 2009 | 300 | 40 |

| 2010 | 350 | 50 |

| 2011 | 450 | 70 |

| 2012 | 600 | 100 |

| 2013 | 800 | 150 |

| 2014 | 1,200 | 200 |

| 2015 | 2,197 | 380 |

| 2016 | 2,328 | 450 |

| 2017 | 2,800 | 600 |

| 2018 | 3,500 | 900 |

| 2019 | 4,200 | 1,200 |

| 2020 | 5,000 | 1,500 |

| 2021 | 5,800 | 1,800 |

| 2022 | 6,542 | 2,369 |

| 2023 | 6,800 | 2,436 |

| 2024 | 7,000 (estimated) | 2,500 (estimated) |

The data highlights China’s remarkable growth, with patent applications surpassing Japan in 2023, reflecting the country’s aggressive push into solid-state battery technology. This trend is further analyzed by examining the distribution of patent applications across major countries and regions, including China, Japan, the United States, South Korea, and the European Patent Office. The competition is particularly intense in polymer and oxide electrolytes, where China leads, while Japan dominates in sulfide electrolytes. The ionic conductivity of solid-state electrolytes, a critical performance metric, can be expressed mathematically as: $$\sigma = n \cdot e \cdot \mu$$ where $\sigma$ is the ionic conductivity, $n$ is the charge carrier concentration, $e$ is the elementary charge, and $\mu$ is the mobility of ions. Enhancements in these parameters have been a focus of patent filings, with innovations targeting values above $10^{-4}$ S/cm for practical applications.

Regional Patent布局 and Technological Focus

The geographic distribution of patent applications for solid-state electrolytes reveals strategic priorities among key players. Japan, an early mover, has concentrated on sulfide-based electrolytes, leveraging their high ionic conductivity, albeit with challenges in stability. The United States and South Korea have diversified their portfolios across polymer and oxide electrolytes, while China has rapidly expanded its presence in all three categories, with a strong emphasis on polymer systems due to their processability and compatibility with existing manufacturing infrastructure. The following table compares the patent applications by technology branch and region as of 2024:

| Region | Polymer Electrolyte Patents | Oxide Electrolyte Patents | Sulfide Electrolyte Patents |

|---|---|---|---|

| China | 5,812 | 4,106 | 3,500 |

| Japan | 3,200 | 4,125 | 5,723 |

| United States | 2,500 | 2,800 | 2,200 |

| South Korea | 1,800 | 1,900 | 2,100 |

| European Patent Office | 1,200 | 1,500 | 1,400 |

This regional specialization underscores the importance of tailoring development strategies to local strengths. For instance, China’s focus on polymer electrolytes aligns with its robust manufacturing sector, whereas Japan’s expertise in sulfides stems from decades of material science research. The evolution of patent filings in each technology branch can be modeled using a logistic growth function: $$P(t) = \frac{K}{1 + e^{-r(t – t_0)}}$$ where $P(t)$ represents the number of patents at time $t$, $K$ is the carrying capacity (maximum potential patents), $r$ is the growth rate, and $t_0$ is the inflection point. This model illustrates the rapid adoption of oxide and sulfide electrolytes post-2017, driven by breakthroughs in material synthesis and interface engineering.

In terms of key applicants, global leaders include Toyota Motor Corporation, Panasonic Group, LG Group, Samsung Group, and NGK Insulators Ltd. These entities have built extensive patent portfolios, with Toyota leading in sulfide electrolytes and LG diversifying across all types. Notably, Chinese applicants like Central South University and the Institute of Physics, Chinese Academy of Sciences, have risen in prominence, though their global patent布局 remains limited compared to Japanese and Korean firms. The following section delves into specific patents that have shaped the industry, highlighting innovations in material composition and battery design.

Analysis of Key Patents in Solid-State Electrolytes

Critical patents in the solid-state battery domain often focus on improving ionic conductivity, stability, and manufacturability. For example, Toyota’s patents related to sulfide electrolytes address the generation of hydrogen sulfide by optimizing glass-forming processes. One such patent discloses a method involving two-step glassification to reduce cross-linked sulfur, enhancing ionic conductivity to over $10^{-4}$ S/cm. The material composition can be represented as: $$\text{Li}x\text{A}_y\text{X}_z\text{S}{1-z}$$ where A is P, Si, Ge, Al, or B, and X is a halogen. This formulation achieves high Li-ion mobility, crucial for all-solid-state batteries.

Similarly, LG Group’s patents span polymer, oxide, and sulfide electrolytes, with innovations in composite structures and surface modifications. A notable patent describes a three-dimensional electrode framework using fibrous carbon materials to improve electronic and ionic conduction. The ionic conductivity in such systems can be approximated by the Nernst-Einstein relation: $$\sigma = \frac{D \cdot n \cdot e^2}{k_B T}$$ where $D$ is the diffusion coefficient, $k_B$ is Boltzmann’s constant, and $T$ is temperature. By incorporating protective layers, such as polyvinylidene carbonate, LG’s patents mitigate degradation and enhance cycle life.

In China, the Institute of Physics has filed patents on hybrid electrolytes, such as LixAlySzO2-z, which combine the benefits of oxides and sulfides. Another patent introduces a frustation-based mechanism in Li8-xAX6-xClx materials, where A is Si or Ti and X is S or Se, leading to room-temperature ionic conductivities on the order of $10^2$ mS/cm. The crystal structure stability is governed by the Gibbs free energy equation: $$\Delta G = \Delta H – T \Delta S$$ where $\Delta H$ is enthalpy change and $\Delta S$ is entropy change, influencing the material’s electrochemical performance.

The table below summarizes key patents from major applicants, emphasizing their technological contributions:

| Applicant | Patent Focus | Key Innovation | Ionic Conductivity (S/cm) |

|---|---|---|---|

| Toyota | Sulfide Electrolyte | Two-step glassification to eliminate cross-linked sulfur | > $10^{-4}$ |

| LG Group | Polymer-Oxide Composite | UV-curable polymer with ceramic fillers for enhanced conduction | $10^{-3}$ – $10^{-4}$ |

| Institute of Physics, China | Hybrid Sulfide-Oxide | Frustration-induced Li+ transport in layered structures | ~ $10^{-1}$ |

| Panasonic | Oxide Electrolyte | Garnet-type LLZO with reduced interfacial resistance | $10^{-4}$ – $10^{-5}$ |

| Samsung | Sulfide Electrolyte | Halogen-free compositions using ZnS and phosphorus compounds | > $10^{-3}$ |

These patents illustrate the ongoing innovation in solid-state batteries, with a clear trend toward multifunctional materials and interface optimization. The cumulative impact of these developments is driving the commercialization of solid-state batteries, expected to reach small-scale production by 2027-2030.

Strategic Recommendations for High-Quality Development

Based on the patent analysis, several strategies can accelerate the growth of the solid-state battery industry. First, enhancing R&D investment in underdeveloped areas, such as sulfide electrolytes, is crucial for balancing global technological capabilities. China, in particular, should leverage its strengths in polymer and oxide electrolytes while addressing gaps in sulfide systems through collaborative research. Second, international patent布局 must be expanded to protect intellectual property in key markets like Europe and North America. Currently, Chinese applicants file predominantly domestically, which could hinder global competitiveness. The probability of successful patent grants can be modeled as: $$P_{\text{grant}} = \frac{1}{1 + e^{-(\beta_0 + \beta_1 X_1 + \beta_2 X_2)}}$$ where $X_1$ represents research investment and $X_2$ represents international collaboration intensity.

Third, fostering industry-academia partnerships can bridge the gap between research and commercialization. Platforms like the “China All-Solid-State Battery Industry-University-Research Innovation Alliance” exemplify this approach, enabling knowledge transfer and joint development. Finally, policy support should focus on standardizing performance metrics, such as energy density and cycle life, to ensure product reliability. For instance, the ionic conductivity threshold for practical solid-state batteries can be derived from the equation: $$\sigma_{\text{min}} = \frac{I \cdot L}{A \cdot \Delta V}$$ where $I$ is current, $L$ is electrolyte thickness, $A$ is area, and $\Delta V$ is voltage drop, emphasizing the need for thin, high-conductivity electrolytes.

In conclusion, the solid-state battery industry is poised for significant growth, driven by continuous innovation in solid-state electrolytes. By analyzing patent trends, we can identify opportunities for strategic development and collaboration, ultimately contributing to a sustainable energy future.

Conclusion

The patent landscape for solid-state batteries reveals a dynamic and competitive field, with solid-state electrolytes at the forefront of innovation. The dominance of regions like China and Japan in specific technology branches highlights the importance of targeted investments and global cooperation. As solid-state batteries advance toward commercialization, stakeholders must prioritize R&D, international patent protection, and synergistic partnerships to harness the full potential of this transformative technology. Through these efforts, the solid-state battery industry can achieve high-quality development, supporting the global transition to clean energy.