As a researcher deeply immersed in energy storage technologies, I find the evolution of solid-state batteries (SSBs) to be one of the most transformative developments in modern electrochemistry. This article synthesizes global advancements, technical hurdles, and strategic imperatives for SSBs, leveraging empirical data, comparative analyses, and thermodynamic frameworks to illuminate pathways toward commercialization.

1. Introduction

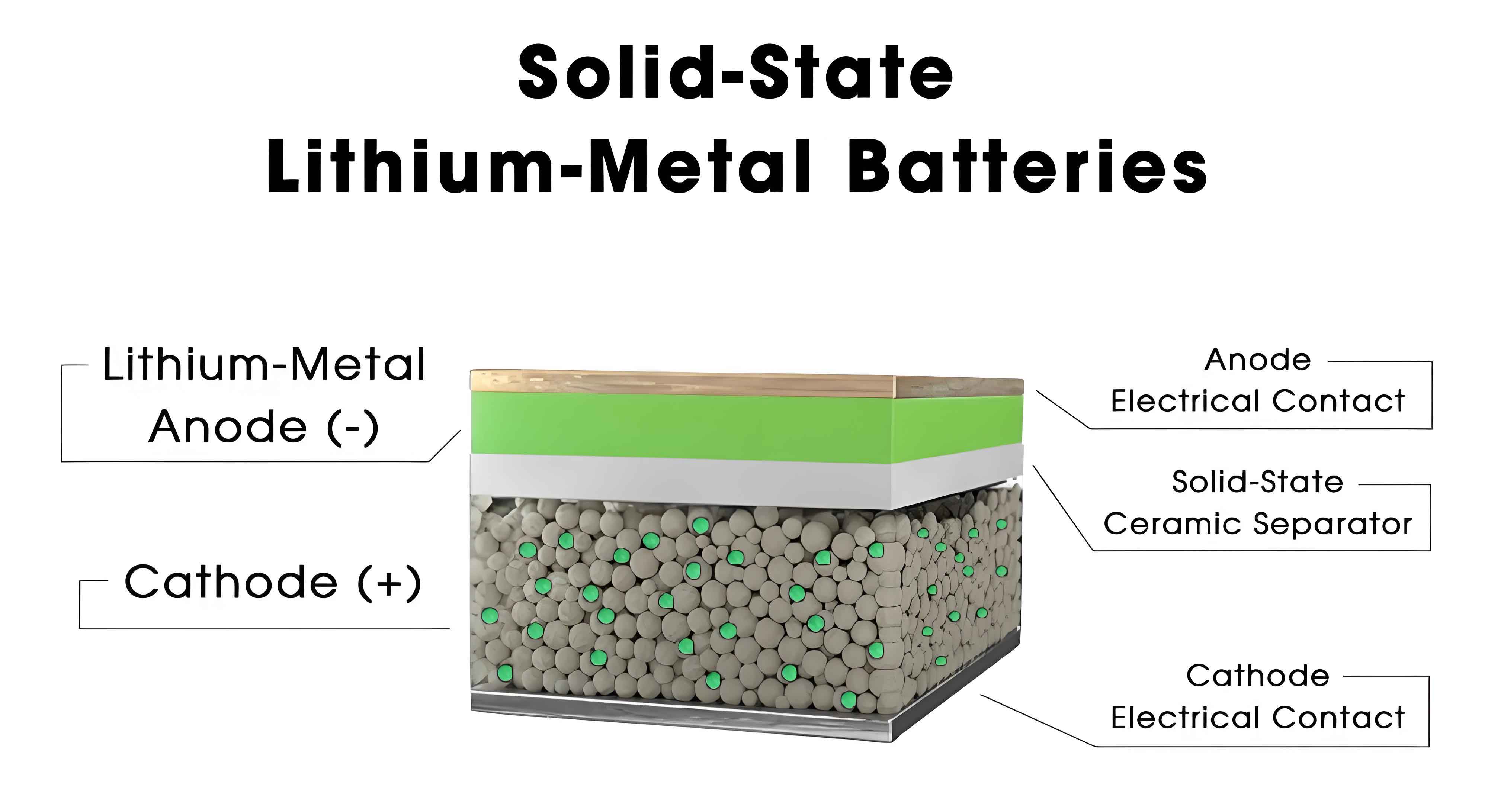

Solid-state batteries represent a paradigm shift from conventional lithium-ion batteries (LIBs), replacing liquid electrolytes with solid alternatives to achieve superior energy density (>500 Wh/kg), enhanced safety (non-flammable electrolytes), and extended cycle life (>1,000 cycles). Despite these theoretical advantages, SSBs face formidable barriers in ionic conductivity, interfacial engineering, and scalable manufacturing. This work dissects these challenges while benchmarking global progress across academia, industry, and policy ecosystems.

2. Technical Pathways for Solid-State Electrolytes

SSB performance hinges on electrolyte materials, which dictate ion transport kinetics and electrochemical stability. Three dominant electrolyte classes—polymers, oxides, and sulfides—exhibit distinct trade-offs (Table 1).

Table 1: Comparative Analysis of Solid Electrolyte Systems

| Parameter | Polymer | Oxide | Sulfide |

|---|---|---|---|

| Ionic Conductivity | 10⁻⁷–10⁻⁴ S/cm (RT) | 10⁻⁶–10⁻³ S/cm (RT) | 10⁻³–10⁻² S/cm (RT) |

| Mechanical Strength | Low | High | Moderate |

| Stability | Poor (≤4 V) | Excellent (≤5 V) | Moderate (sensitive to O₂/H₂O) |

| Scalability | High (film-based) | Moderate | Low (synthesis complexity) |

| Key Players | Bolloré, Solid Power | QuantumScape, CATL | Toyota, Samsung SDI |

2.1 Polymer Electrolytes

Polyethylene oxide (PEO)-based electrolytes dominate due to flexibility and processability. However, their low room-temperature conductivity (σ ≈ 10⁻⁵ S/cm) necessitates operation at 60–80°C. Recent advances in copolymer blends (e.g., PEO-LiTFSI with ceramic fillers) have improved σ to 10⁻⁴ S/cm at 30°C, albeit with trade-offs in mechanical integrity.

2.2 Oxide Electrolytes

Garnet-type (Li₇La₃Zr₂O₁₂) and perovskite (LLTO) oxides offer high oxidative stability (>5 V vs. Li/Li⁺) but suffer from grain boundary resistance. Sintering techniques and doping (e.g., Al³⁺ in LLZO) enhance bulk conductivity to ~10⁻³ S/cm. QuantumScape’s anode-free design exemplifies progress, achieving 800+ cycles at 1C rate with >90% capacity retention.

2.3 Sulfide Electrolytes

Sulfides like Li₁₀GeP₂S₁₂ (LGPS) achieve σ ≈ 10⁻² S/cm—rivaling liquid electrolytes—but require inert atmospheres due to hygroscopicity. Toyota’s prototype SSB (2023) leverages Li₆PS₅Cl argyrodite, demonstrating 1,200 km range with 10-minute charging.

3. Global Industry Landscape

National strategies and corporate R&D investments reveal stark asymmetries in SSB development (Table 2).

**Table 2: National/Corporate SSB Initiatives (2021–2025)**

| Region/Entity | Investment (USD) | Key Milestones | Commercialization Target |

|---|---|---|---|

| Japan (METI) | $8.2B | Toyota’s 1,200-km SSB prototype (2023) | 2027–2028 |

| South Korea | $15B | Samsung SDI’s 900 Wh/L prototype (2022) | 2027 |

| EU (Battery 2030+) | $35B | SolidPower’s 390 Wh/kg cell (2023) | 2030 |

| China (CATARC) | $12B | Semi-SSBs in NIO ET7 (360 Wh/kg, 2023) | 2026–2030 |

| USA (DOE) | $6B | SES AI’s hybrid Li-Metal SSB (2024) | 2028 |

3.1 Japan’s Leadership

Japan’s consortium of Toyota, Panasonic, and 38 institutes has filed 2,048 SSB patents (2000–2023), focusing on sulfide electrolytes. Toyota’s breakthrough in interfacial stress management (2023) reduced cell thickness by 50%, targeting $75/kWh by 2030.

3.2 China’s Semi-Solid Strategy

Chinese firms prioritize hybrid designs (5–10% liquid electrolyte) to accelerate commercialization. CATL’s condensed battery (500 Wh/kg) and WeLion’s 360 Wh/kg cells exemplify this approach, albeit with trade-offs in safety and temperature range.

4. Technological Challenges

Four interlinked barriers impede SSB adoption:

4.1 Ionic Transport Limitations

Solid electrolytes exhibit lower ionic conductivity than liquids, governed by the Arrhenius equation:σ=σ0⋅exp(−kBTEa)

where Ea is activation energy, kB Boltzmann’s constant, and T temperature. For oxides (Ea≈0.3–0.5 eV), σ plateaus at ~10⁻³ S/cm, necessitating nanostructuring (e.g., Li₃PS₄ nanopillars) to reduce Ea.

4.2 Interfacial Degradation

Electrode-electrolyte interfaces develop high impedance (Rinterface>100 Ω⋅cm2) due to lithiation strain and space charge layers. In situ polymerization and buffer layers (e.g., Li₃N coatings) mitigate this but add cost.

4.3 Lithium Dendrite Propagation

Despite solid electrolytes’ mechanical rigidity (E>1 GPa), Li filaments penetrate grain boundaries at current densities >1 mA/cm². Operando XRD studies reveal that stack pressure (>10 MPa) suppresses dendrites but complicates pack design.

4.4 Manufacturing Complexity

SSB production requires novel techniques like aerosol deposition (for thin films) and spark plasma sintering, escalating capex. Current costs for sulfide SSBs exceed 300/kWhvs.130/kWh for LIBs.

5. Cost and Scalability Projections

A techno-economic model for SSB gigafactories reveals critical cost drivers (Table 3).

**Table 3: Cost Breakdown of SSB Production (2030 Projection)**

| Component | Cost Share (%) | Key Innovations for Cost Reduction |

|---|---|---|

| Solid Electrolyte | 35 | Scale-up of Li₂S synthesis (<$50/kg) |

| Cathode (NMC 811) | 25 | Dry electrode coating |

| Anode (Li Metal) | 20 | Roll-to-roll Li foil deposition |

| Manufacturing | 15 | 3D printing of multilayer cells |

| R&D/Tooling | 5 | Modular production lines |

6. Strategic Recommendations

To solidify leadership in SSBs, stakeholders must:

- Prioritize Oxide-Sulfide Synergies: Hybrid electrolytes (e.g., Li₆PS₅Cl + LLZO) could balance conductivity and stability.

- Standardize Testing Protocols: ASTM/ISO standards for SSB safety (nail penetration, thermal runaway) are urgently needed.

- Leverage AI/ML: High-throughput screening of dopants (e.g., replacing Ge with Sn in LGPS) via machine learning.

- Recycle Infrastructure: Develop closed-loop systems for Li and rare metals (La, Zr) to offset raw material costs.

7. Conclusion

The transition to solid-state batteries is not merely incremental but revolutionary, demanding unprecedented collaboration across materials science, process engineering, and policy domains. While Japan and Korea lead in sulfide electrolytes, China’s semi-solid pivot offers near-term market penetration. Global success hinges on resolving interfacial mysteries and achieving <$100/kWh costs—a feat that will redefine energy storage for decades.