As I delve into the transformative landscape of energy storage, it becomes increasingly clear that solid-state batteries are poised to redefine the future of electric mobility and renewable energy integration. The shift from liquid electrolyte systems to solid-state batteries represents not merely an incremental improvement but a fundamental overhaul of battery technology. In my analysis, the core advantages of solid-state batteries—such as exceptional energy density, enhanced safety profiles, broad operational temperature ranges, and superior power capabilities—are driving global efforts to commercialize this technology. The anticipated timeline, with 2027 as a pivotal year for initial vehicle integration, underscores the urgency and scale of this transition. Throughout this exploration, I will emphasize the technological pathways, challenges, and innovative solutions shaping the development of solid-state batteries, while incorporating quantitative analyses through tables and formulas to elucidate key points.

The evolution of solid-state batteries hinges on the choice of electrolyte materials, which fundamentally differentiate them from conventional liquid lithium-ion batteries. In my assessment, four primary electrolyte systems have emerged in global research: sulfide-based, oxide-based, polymer-based, and halide-based electrolytes. Among these, the sulfide route has gained prominence as the leading candidate for near-term industrialization, owing to its high ionic conductivity, which facilitates efficient ion transport. However, each system presents a unique set of trade-offs. For instance, while sulfide electrolytes excel in conductivity, they suffer from instability and high costs; oxide electrolytes offer mechanical robustness but face interface challenges; polymer electrolytes are easier to process but lag in ionic performance; and halide systems remain in earlier stages of development. To illustrate this, I have compiled a comparative table below that summarizes the characteristics of these electrolyte types, based on current research and industry trends.

| Electrolyte Type | Ionic Conductivity (S/cm) | Stability | Cost Estimate (USD/kg) | Key Challenges |

|---|---|---|---|---|

| Sulfide | 10^{-2} to 10^{-3} | Low (prone to degradation) | 6000-8000 (projected 2026) | Interface issues, H₂S generation |

| Oxide | 10^{-4} to 10^{-6} | High (thermal/mechanical) | 2000-5000 | Poor interfacial contact, brittleness |

| Polymer | 10^{-5} to 10^{-7} | Moderate | 1000-3000 | Low conductivity at room temperature |

| Halide | 10^{-3} to 10^{-4} | Variable | 5000-10000 | Limited data, synthesis complexity |

From my perspective, the dominance of the sulfide pathway in current industry roadmaps is not accidental. Its high ionic conductivity, often represented by the Arrhenius equation for ion transport, $$ \sigma = \sigma_0 \exp\left(-\frac{E_a}{kT}\right) $$ where (\sigma) is the ionic conductivity, (\sigma_0) is the pre-exponential factor, (E_a) is the activation energy, (k) is Boltzmann’s constant, and (T) is temperature, enables faster charging and discharging cycles. However, the instability of sulfide materials, particularly their reactivity with moisture leading to toxic by-products like H₂S, necessitates careful handling and composite approaches, such as blending with polymers. In my view, this hybrid strategy could mitigate weaknesses while capitalizing on the strengths of multiple electrolyte types, aligning with the industry’s move toward material fusion for optimized performance.

As I project the developmental trajectory of solid-state batteries, a clear timeline emerges, segmented into phases that target specific energy density milestones. The following table outlines the key stages from 2025 to beyond 2030, focusing on sulfide-based systems, which are currently at the forefront of research and development efforts. This phased approach reflects a strategic shift from incremental improvements to radical innovations in electrode and electrolyte materials.

| Time Period | Target Energy Density | Key Materials | Primary Goals |

|---|---|---|---|

| 2025-2027 | 200-300 Wh/kg | Graphite/low-silicon anode, high-nickel ternary cathode | Establish sulfide electrolyte production, achieve >1000 cycles |

| 2027-2030 | 400 Wh/kg, 800 Wh/L | High-silicon anode, maintained cathode and electrolyte | Enable next-gen EVs with extended range and fast charging |

| Post-2030 | 500 Wh/kg, 1000 Wh/L | Lithium metal anode, composite electrolytes | Pioneer ultra-high density for advanced applications |

In my evaluation, the energy density targets are critical for overcoming range anxiety in electric vehicles. The gravimetric energy density, defined as $$ \text{Energy Density} = \frac{\text{Total Energy}}{\text{Mass}} $$ and volumetric energy density, $$ \text{Volumetric Energy Density} = \frac{\text{Total Energy}}{\text{Volume}} $$ must be optimized simultaneously. For instance, achieving 400 Wh/kg and 800 Wh/L would allow electric vehicles to surpass 1500 km per charge, effectively eliminating the need for frequent recharging. I believe that the progression from graphite-based anodes to silicon-carbon and eventually lithium metal anodes will drive these gains, though each step introduces new complexities in interface management and material compatibility.

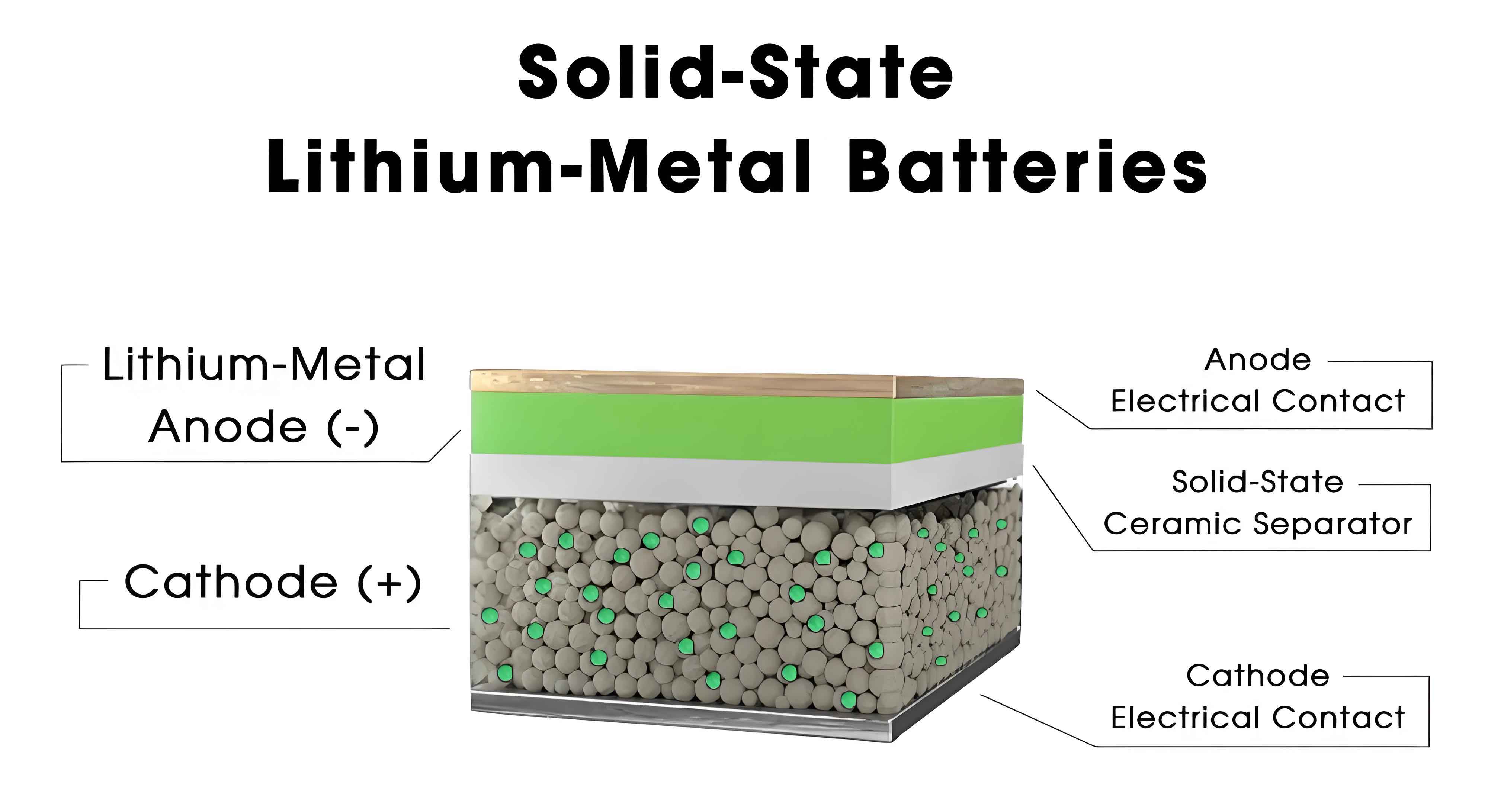

To better understand the structural aspects of solid-state batteries, consider the following visualization, which highlights the layered composition of a typical cell. This image serves as a reference for the discussions on material interactions and design innovations.

However, the path to commercialization is fraught with challenges that I must address in detail. Chief among these is the cost disparity between solid-state batteries and their liquid counterparts. Based on current estimates, the material cost for liquid lithium-ion batteries hovers around \$0.5 per Wh, whereas solid-state batteries incur costs of approximately \$2 per Wh. This can be expressed mathematically for a standard battery pack: $$ \text{Cost}{\text{solid-state}} = 4 \times \text{Cost}{\text{liquid}} $$ For a 100 kWh pack, this translates to over \$20,000 in material costs alone for solid-state batteries, compared to \$5,000 for liquid types. The high expense is largely attributed to specialized materials like sulfide electrolytes, which rely on硫化锂 (lithium sulfide) priced at \$7,000-\$8,000 per kg in 2024, with projections dropping to \$6,000 per kg by 2026. Despite this reduction, it remains substantially higher than liquid electrolytes, underscoring the need for economies of scale and process optimizations.

Another significant hurdle I have identified is the solid-solid interface issue. In solid-state batteries, the contact between electrodes and electrolytes is inherently poor due to the absence of a liquid medium, leading to increased interfacial resistance. This resistance, denoted as ( R_{\text{interface}} ), contributes to the total internal resistance ( R_{\text{total}} ) of the battery: $$ R_{\text{total}} = R_{\text{bulk}} + R_{\text{interface}} $$ where ( R_{\text{bulk}} ) represents the resistance within the electrolyte and electrode materials. Minimizing ( R_{\text{interface}} ) is crucial for maintaining high efficiency and longevity, as it directly impacts the battery’s ability to sustain rapid charge-discharge cycles. In practice, this involves engineering interfaces through coatings, additives, or composite structures, but these solutions add complexity and cost. I estimate that overcoming interface challenges could improve cycle life by up to 50%, making it a focal point for ongoing research.

Production processes for solid-state batteries also present obstacles. The manufacturing of thin, uniform electrolyte films—essential for compact cell designs—requires precision techniques such as dry room processing or advanced deposition methods. The yield rate, often below 80% in pilot lines, compared to over 95% for liquid batteries, exacerbates costs. A formula to capture this is: $$ \text{Yield} = \frac{\text{Usable Cells}}{\text{Total Cells Produced}} \times 100\% $$ Low yields stem from defects like pinholes in electrolytes or poor interfacial adhesion, necessitating investments in specialized equipment. I project that scaling production to gigawatt-hour levels could reduce costs through learning curves and automation, but initial capital outlays remain high, potentially delaying widespread adoption.

In response to these challenges, I am encouraged by the role of artificial intelligence in accelerating the development of solid-state batteries. AI tools, including machine learning models and high-throughput simulation platforms, are revolutionizing material discovery and optimization. For example, AI can screen thousands of electrolyte candidates by predicting properties like ionic conductivity and stability using quantum-chemical calculations. The efficiency gain can be quantified as: $$ \text{Time Savings} = \frac{T_{\text{traditional}}}{T_{\text{AI}}} $$ where ( T_{\text{traditional}} ) might involve years of trial-and-error, while ( T_{\text{AI}} ) compresses this to months or weeks. In my observation, AI-driven approaches have already reduced R&D expenses by 70-80% in some cases, enabling faster iteration on composite materials and interface designs. Furthermore, AI facilitates the development of digital twins for batteries, allowing virtual testing of performance under various conditions, which enhances reliability while cutting physical prototyping costs.

The integration of AI into solid-state battery research extends to lifecycle management and safety assessments. For instance, predictive models can estimate degradation rates based on stress factors like temperature and charge rates, using equations such as: $$ \text{Degradation Rate} = k \cdot \exp\left(-\frac{E_a}{RT}\right) $$ where ( k ) is a rate constant, ( E_a ) is activation energy, ( R ) is the gas constant, and ( T ) is temperature. By leveraging large datasets from experimental results, AI algorithms identify patterns that human researchers might overlook, thereby optimizing formulations for longer lifespan and better safety. I anticipate that as AI tools become more sophisticated, they will unlock novel material combinations, potentially leading to breakthroughs in solid-state battery performance that exceed current projections.

On a global scale, the competition for leadership in solid-state battery technology is intensifying, with patent landscapes revealing strategic positioning by various regions. As of recent analyses, nearly 40% of global patents related to solid-state batteries are held by entities in one particular region, highlighting the importance of intellectual property in securing market advantages. I urge stakeholders to prioritize original IP creation and participation in international standard-setting bodies to avoid dependencies and foster collaboration. The following table summarizes key areas of focus for enhancing global competitiveness in this field.

| Area | Current Status | Recommended Actions |

|---|---|---|

| Intellectual Property | Concentrated in certain regions, risk of封锁 | Accelerate original filings, cross-licensing |

| Standardization | Emerging, lacks unified safety protocols | Develop international standards, promote transparency |

| Industry Collaboration | Fragmented, with siloed efforts | Foster open innovation platforms, share pre-competitive data |

| Cost Reduction | High material and production costs | Invest in scaling, alternative materials, recycling |

Looking ahead, I am optimistic about the long-term impact of solid-state batteries on energy systems. Once commercialized at scale, these batteries could enable electric vehicles to achieve ranges exceeding 2000 km, effectively rendering charging infrastructure less critical for daily use. This shift might redefine mobility patterns, opening up applications in extreme environments or long-haul transport. Moreover, the integration of solid-state batteries with renewable energy storage could enhance grid stability, as their high efficiency and safety support higher penetration of intermittent sources like solar and wind. In my view, the transition from liquid to solid-state systems will not happen overnight; it may take a decade or more for solid-state batteries to capture a significant market share. However, the relentless pace of innovation, coupled with AI-driven efficiencies, suggests that the 2030 targets for mass commercialization could be achieved sooner than anticipated.

In conclusion, as I reflect on the journey toward solid-state battery adoption, it is evident that we are witnessing a paradigm shift in energy storage. The focus on sulfide-based electrolytes, the structured roadmap toward higher energy densities, and the collaborative efforts to overcome cost and interface challenges all point to a future where solid-state batteries become the cornerstone of clean energy systems. By embracing interdisciplinary approaches and leveraging technological advancements, we can accelerate this transition, ultimately contributing to a more sustainable and resilient global energy landscape. The era of solid-state batteries is dawning, and I am confident that it will redefine our relationship with energy and mobility in profound ways.