As I delve into the rapidly evolving landscape of energy storage, one innovation stands out with transformative potential: the solid-state battery. This technology, poised to redefine the future of electric vehicles (EVs) and renewable energy systems, is inching closer to commercialization. Yet, challenges such as material science bottlenecks, interfacial engineering, and cost parity with conventional lithium-ion batteries remain formidable. Here, I synthesize the latest advancements, technical hurdles, and market trajectories of solid-state batteries, leveraging data, tables, and formulas to illuminate this groundbreaking field.

1. The Solid-State Battery Revolution

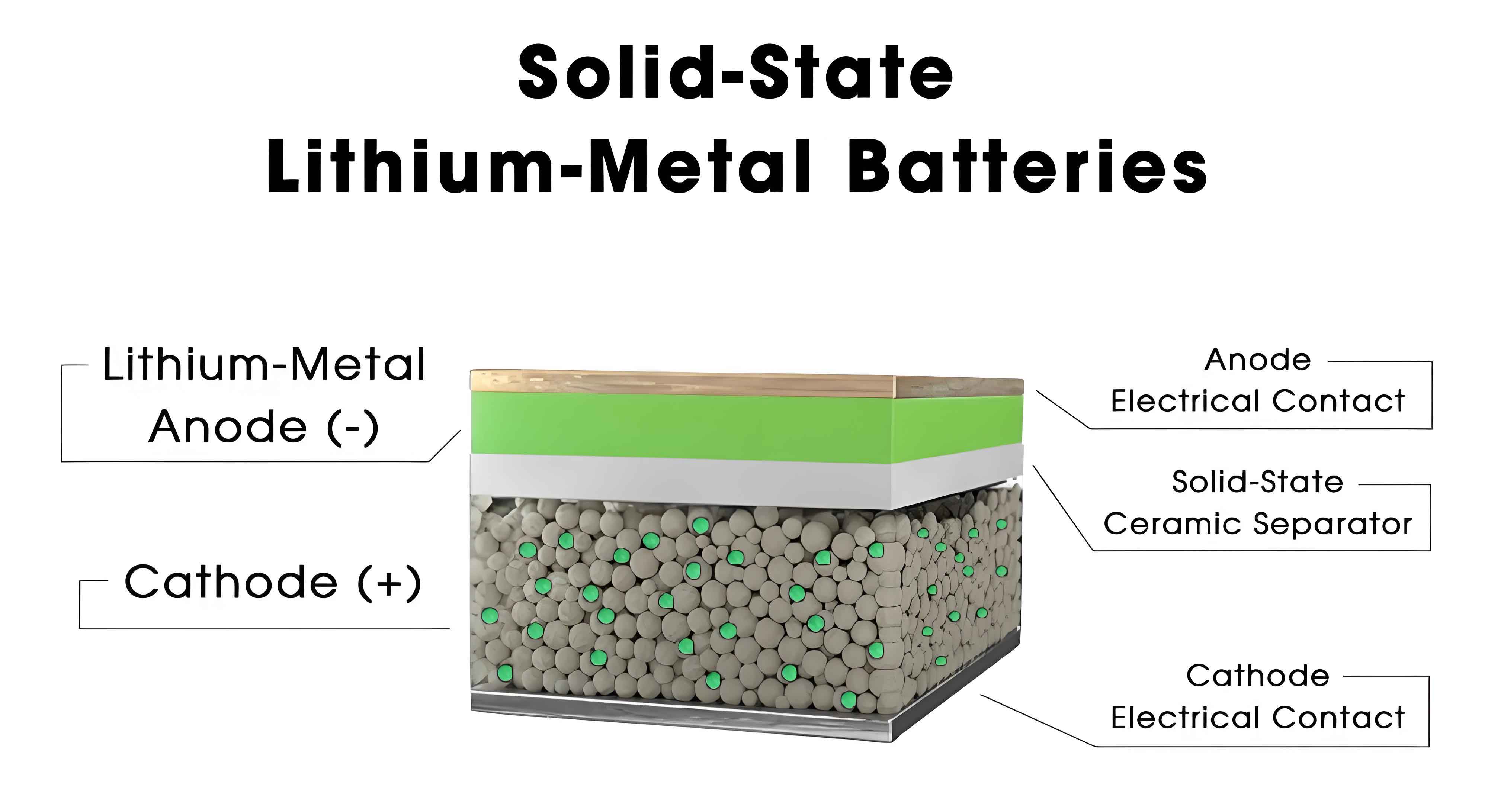

Solid-state batteries (SSBs) replace the flammable liquid electrolyte in traditional lithium-ion batteries with a solid electrolyte, unlocking unparalleled advantages:

- Higher energy density: Target benchmarks exceed 400 Wh/kg, doubling current lithium-ion capabilities.

- Enhanced safety: Elimination of volatile liquid electrolytes mitigates fire risks.

- Longer lifespan: Projected cycle life surpasses 1,000 cycles at full capacity.

The global race to commercialize SSBs is intensifying. Major automakers and battery giants—BYD, CATL, and Toyota—have outlined ambitious timelines (Table 1).

Table 1: Solid-State Battery Commercialization Roadmaps

| Company | Key Milestones | Target Year |

|---|---|---|

| BYD | Pilot production for EVs | 2027 |

| CATL | Small-scale production begins | 2027 |

| Toyota | Mass production for EVs | 2030 |

| SAIC Motor | Full-scale deployment in flagship models | 2026 |

| QuantumScape | Gigafactory operational | 2028 |

2. Technical Breakthroughs and Challenges

2.1 Material Innovations

The core of SSBs lies in the solid electrolyte. Three primary candidates dominate research:

- Sulfide-based electrolytes: High ionic conductivity (σLi+>10−2 S/cmσLi+>10−2S/cm), but chemically unstable.

- Oxide-based electrolytes: Superior stability but lower conductivity (σLi+≈10−4 S/cmσLi+≈10−4S/cm).

- Polymer-based electrolytes: Flexible yet plagued by low thermal tolerance.

The ideal solid electrolyte must satisfy:σLi+≥10−3 S/cm , Egap>4.5 eV , and ΔV<0.1 VσLi+≥10−3S/cm,Egap>4.5eV,andΔV<0.1V

where EgapEgap is the electrochemical stability window, and ΔVΔV denotes interfacial resistance.

2.2 Interfacial Engineering

Poor contact between electrodes and solid electrolytes remains a critical bottleneck. The interfacial resistance (RinterfaceRinterface) can degrade performance by up to 40%. Strategies to mitigate this include:

- Nanoscale coatings: Applying Li₃PO₄ or LiNbO₃ layers to enhance adhesion.

- Pressure optimization: Stack pressure > 5 MPa improves ionic contact.

3. The Cost Conundrum: Achieving “Solid-Liquid Price Parity”

Today, SSBs cost 3–5× more than liquid lithium-ion batteries. However, economies of scale and manufacturing innovations could narrow this gap. A simplified cost model illustrates the pathway:CSSB=Cmaterial+Cproduction+CCSSB=Cmaterial+Cproduction+C

Table 2: Cost Reduction Levers for Solid-State Batteries

| Factor | Current Contribution | 2030 Projection |

|---|---|---|

| Material Costs | 55% | 40% |

| Production Efficiency | 30% | 45% |

| R&D Amortization | 15% | 15% |

Key drivers include:

- Dry electrode processing: Eliminates solvent use, cutting production costs by 20%.

- AI-driven material discovery: Accelerates R&D cycles, reducing time-to-market by 30%.

4. The Role of AI in Accelerating Development

Machine learning algorithms are revolutionizing SSB research. For instance, generative adversarial networks (GANs) can predict novel electrolyte compositions with target properties:GAN Output=argmaxx P(σLi+>10−3 ∣ x)GAN Output=argxmaxP(σLi+>10−3∣x)

Companies like CATL and Samsung SDI are deploying AI to optimize electrode architectures and simulate degradation mechanisms, slashing prototyping costs by 50%.

5. Market Projections and Strategic Implications

By 2030, SSBs are projected to capture 15–20% of the global EV battery market, driven by regulatory mandates and consumer demand for safer, longer-range vehicles. Regional dynamics will shape adoption:

- China: State-backed initiatives aim for 50 GWh SSB capacity by 2030.

- Europe: Strict CO₂ regulations favor SSB integration in luxury EVs.

- North America: Tech startups dominate early-stage innovation.

6. Conclusion: The Road Ahead

The solid-state battery is no longer a distant dream but a tangible reality nearing industrial maturity. While challenges like interfacial resistance and cost persist, collaborative efforts across academia, industry, and governments are paving the way for a paradigm shift. As SSBs evolve from lab-scale prototypes to mass-produced powerhouses, they promise to electrify our future—literally and figuratively.